正午阳光 | 青年学者论坛(2025秋季)第10期

“正午阳光——青年学者论坛”是金融学院定期举办的以院内师生参与为主的学术交流活动,为全院专家学者之间、师生之间、南开金融与国际国内学术界之间提供了难得的交流机会。本学期“正午阳光”论坛初心不改,扬帆远航再出发,致力于营造学院学校科研氛围,推动师生学术科研水平不断提升!

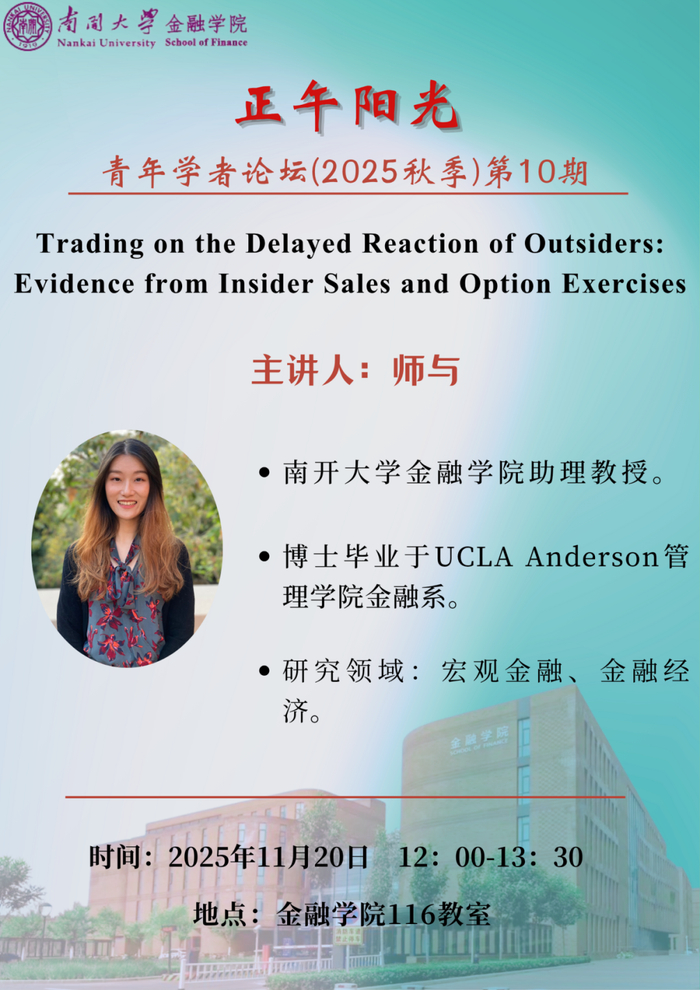

2025年秋季学期 “正午阳光——青年学者论坛”第10期活动安排如下:

讲座信息

讲座题目

Trading on the Delayed Reaction of Outsiders: Evidence from Insider Sales and Option Exercises.

主讲人:师与

南开大学金融学院助理教授。博士毕业于UCLA Anderson管理学院金融系。主要研究领域:宏观金融、金融经济。

讲座时间

2025年11月20日(周四)

12:00-13:30

讲座地点

金融学院116教室

内容摘要

This paper investigates the strategic timing and structuring of share disposals by corporate insiders. We develop a model in which heterogeneous outsider reaction speeds to positive information generate temporary periods of high liquidity and price appreciation as the market gradually incorporates the information. The model predicts that insiders, possessing superior knowledge of fundamental value, sell into these liquidity surges while strategically using option exercises to minimize their market impact. Using comprehensive U.S. insider transaction data from 1996 to 2024, we find strong empirical support for three key predictions: (1) the standard negative liquidity-return relationship reverses around insider sales, with high liquidity predicting higher subsequent returns; (2) insiders are significantly more likely to use the "exercise-and-sell" method following sharp increases in ex-ante returns; and (3) this strategic timing is more pronounced among executive officers than directors, a finding further supported with causal evidence from role changes. Our results reveal a new channel of informed trading based on interpreting public information and highlight important limitations of current regulatory frameworks such as Rule 10b5-1.

https://finance.sina.com.cn/wm/2025-11-18/doc-infxvifa4043963.shtml